nebraska tax withholding calculator

Free federal and nebraska paycheck withholding calculator. Switch to Nebraska hourly calculator.

Tax Withholding For Pensions And Social Security Sensible Money

To use our Nebraska Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

. State Date State Nebraska. Essex Ct Pizza Restaurants. Nebraska Paycheck Calculator - SmartAsset SmartAssets Nebraska paycheck calculator shows your hourly and salary income after federal state and local taxes.

Here are some of the changes associated with withholding tax as a whole. The Nebraska Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Nebraska State Income Tax Rates and Thresholds in 2022. Form W-3N Due Date.

Calculate your Nebraska net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Nebraska paycheck calculator. Nebraska Department of Revenue Contact Information. Nebraska local sales tax rates Lists towns and local tax rates.

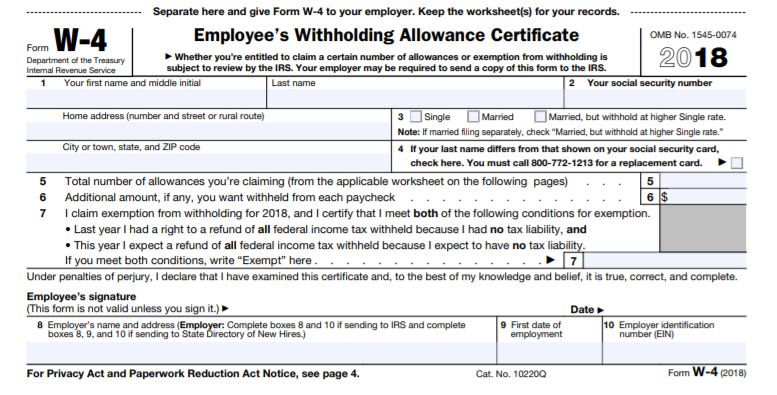

Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings. Find your pretax deductions including 401K flexible account contributions. The Nebraska income tax calculator is designed to provide a salary example with salary deductions made in Nebraska.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Nebraska. Both cardholders will have equal access to and ownership of all funds added to the card account.

Reducing the number of withholding allowances to 2 for state purposes only would set the withholding amount at 240 which falls within the nonshaded area of the table. Payroll check calculator is updated for payroll year 2022 and new W4. State Date State Nebraska.

Switch to salary Federal Taxes. Soldier For Life Fort Campbell. Internal Revenue Service Get information forms instructions and answers about your federal income taxes.

The calculator can figure out all of the federal and Nebraska state payroll taxes for you and your employees. Highlights include links to FreeFile free tax software and the IRS withholding calculator. 19 in Nebraska and Alabama 21 in Puerto Rico Identity verification is required.

August 5 2021 by Kevin E. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Nebraska Tax Withholding Calculator.

This free easy to use payroll calculator will calculate your take home pay. The Nebraska tax calculator is updated for the 202223 tax year. How to Calculate 2020 Nebraska State Income Tax by Using State Income Tax Table.

There is no commitment to pay for Social Security for the earned income above this base limit as well as the price is equivalent for each worker. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. The Nebraska Department of Revenue is issuing a new Nebraska Circular EN for 2022.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Income Tax Rate Indonesia. Nebraska tax withholding calculator Nebraska Withholding Tax.

All you have to do is input wage and W-4 information for each employee into the calculator and it will do the rest. March 1 2022. Launch Free Calculator OR See Nebraska tax rates Federal Payroll Taxes.

Restaurants In Matthews Nc That Deliver. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Delivery Spanish Fork Restaurants. Instead you fill out steps 2 3 and 4. Nebraska tax withholding calculator.

Enter your info to see your take home pay. The Nebraska Department of Revenue is responsible for publishing the. All tables within the Circular EN have changed and should be used for wages pensions and annuities and gambling winnings paid on or after January 1 2022.

Click image to enlarge Set up company tax information option. There are four tax brackets in Nevada and they vary based on income level and filing status. Change state Check Date General Gross Pay Gross Pay Method.

Nebraska Withholding Tax Federal. Find your income exemptions. Select the rigth Pay Period Start ezPaycheck application click the left menu Company Settings then click the sub menu Company to open the company setup screen.

Nebraska Withholding Tax Federal. Income Tax Withholding Reminders for All Nebraska Employers Circular EN. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you.

Nebraska State Tax Forms. Use tab to go to the next focusable element. Check the 2020 Nebraska state tax rate and the rules to calculate state income tax.

It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. In 2012 nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable. Please make sure you select the correct Pay Period there.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. Calculating the withholding at 15 would result in a withholding amount of 788 525 X 015 over 10 times the amount originally determined. Supports hourly salary income and multiple pay frequencies.

The Nebraska Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Nebraska State Income Tax Rates and Thresholds in 2022. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

The Social Security tax withholding is rated at 62 by the federal government up to the base of 2021 annual wage at 142800. 691 rows In 2012 Nebraska cut income tax rates across the board and. October 14 2021 Effective.

State copies of 2021 Forms W. The Nebraska Form W-4N is completed by the employee to determine the number of allowances that the employer uses in conjunction with the Nebraska Circular EN to calculate the Nebraska income tax withholding. Opry Mills Breakfast Restaurants.

The NE Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NES. Find your gross income.

Nebraska Income Tax Ne State Tax Calculator Community Tax

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Paycheck Tax Withholding Calculator For W 4 Tax Planning

The Four Rules Personal Budget Budgeting Ways To Save Money

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Sales Tax By State Is Saas Taxable Taxjar

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Lili S Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Income Tax Ne State Tax Calculator Community Tax

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Income Tax Ne State Tax Calculator Community Tax

State W 4 Form Detailed Withholding Forms By State Chart

Accounting For Agriculture Federal Withholding After New Tax Bill Unl Beef

Nebraska Income Tax Ne State Tax Calculator Community Tax

Income Tax Calculator Estimate Your Refund In Seconds For Free